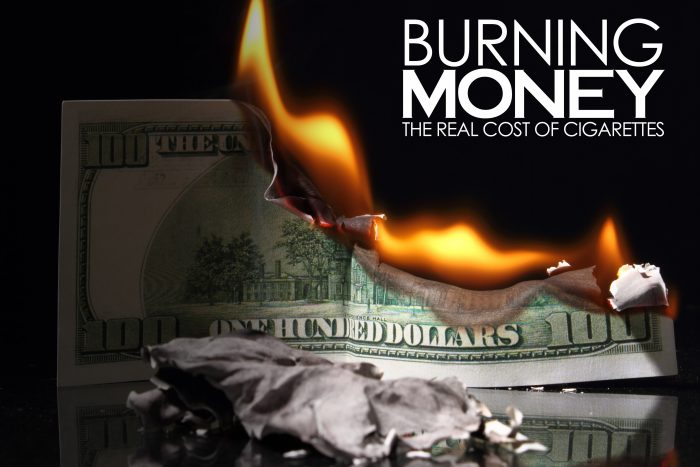

When you light up a cigarette, do you think to yourself, “Man, I wish I had never started smoking”? You also probably hate it when someone else says something judgmental about your addiction. Well, I’m not here to judge you. Maybe your conscience gives you enough grief for your habit already. I’m just here to give you cold, hard facts about how being a smoker impacts your insurance.

The most obvious type of insurance affected is your health insurance. Smoking causes your rates to increase because your risk for disease and cancer increases. Your rates are roughly 20% more than a non-smokers rates. You already knew that. Never mind the health insurance increase.

Let’s focus instead on the less obvious way you have to spend more money on insurance.

Dental care is more expensive for smokers. The smoke damages your teeth and gums, putting you at an increased risk for gum and mouth disease. Smoking is also one of the main causes of tooth loss. All these dental bills can get expensive, so your insurance company will raise your rates to make up for the difference.

Cigarettes are the number one cause of house fires; in America, over 20,000 housefires a year are caused by cigarettes. Because of this fact, your homeowner’s insurance rates are increased.

The higher your claim risk is, the higher your rates are.

By: KayLynn

By: KayLynn